It is almost tax time and you are doing what most businesses are doing at this time of year – considering purchasing some significant items before June 30 to add some expenses to the business, therefore reducing your tax.

Your accountant wants to be clever by doing their job and saving you money, however most accountants do not understand Home Warranty Insurance in detail and the issues it can cause.

Here are some common areas where builders go wrong:

- Running your financial numbers down so you pay no tax

- Your accountant decides to create loans to yourself. The problem is the loan now owed to the business (asset) which could be worth hundreds of thousands of dollars on the balance sheet, is now worth nothing due to the Adjusted Net Tangible Assets (ANTA) calculation

- Do some developments and run them with no margin to save yourself money personally, however your margin is now too low for Home Warranty Insurance regulations

This is all great, however you are a builder and there is this thing called Home Warranty Insurance which you need to comply with or you cannot build homes. If you are not able to build homes, this means you cannot produce revenue and therefore do not have a business.

So what do you do?

Firstly, we need to look for what home warranty insurance mostly looks for. The Home Building Compensation Fund (HBCF) want a healthy business that can sustain a few mis-estimates, downturns in the economy or slow payments from clients. Therefore they focus on the following areas:

- A strong balance sheet

- Good working capital

- Healthy margins

Secondly, you need to identify whether your business is looking for growth, maintaining your current position or looking to downsize. The reason for this is, it will determine what your ANTA position will need to be now and into the future. The ANTA calculation factors in multiple things and is an average across the last two financial years. So if you try to be clever and rectify your financial position midway through the year, it won’t matter because they average the last two financial tax periods and not interims.

- So confirming, if you are looking to grow the business, you are going to need to look at retaining money in the business so your ANTA calculation has a good balance sheet to work off.

- If you are looking to maintain your business position, all you have to do is work out what your ANTA status is and if this amount services your existing requirements. After this calculation you are then free to look for ways to reduce your tax as long as you stay above your ANTA requirement line.

- If you are looking to downsize, this gives you the opportunity to extract a little more from the business, because a high Home Warranty limit may not be required in the future, therefore your ANTA position may not need to look as good. This gives you the oportunity to be a little more creative in your accounting.

Most builders are looking to grow their business and quite often your accountant does not understand the rules and regulations around home warranty insurance (not due to their ability, it is just that the scheme goes against everything an accountant is taught to do) and may inadvertently destroy your business just by doing their job and doing what is normal practice in other industries.

I stress, be conscious of this when talking with your accountant because it can set your business back two or more years very easily.

If you need some advice on this leading up to tax time, please contact us.

What is the best way to save tax yet not impact your Home Warranty Insurance limits?

I would suggest you complete an ANTA calculation test so you can know exactly what your ANTA position is, then work out what your HWI limits would be based on these numbers. This will quickly identify whether you are in deficit or in surplus.

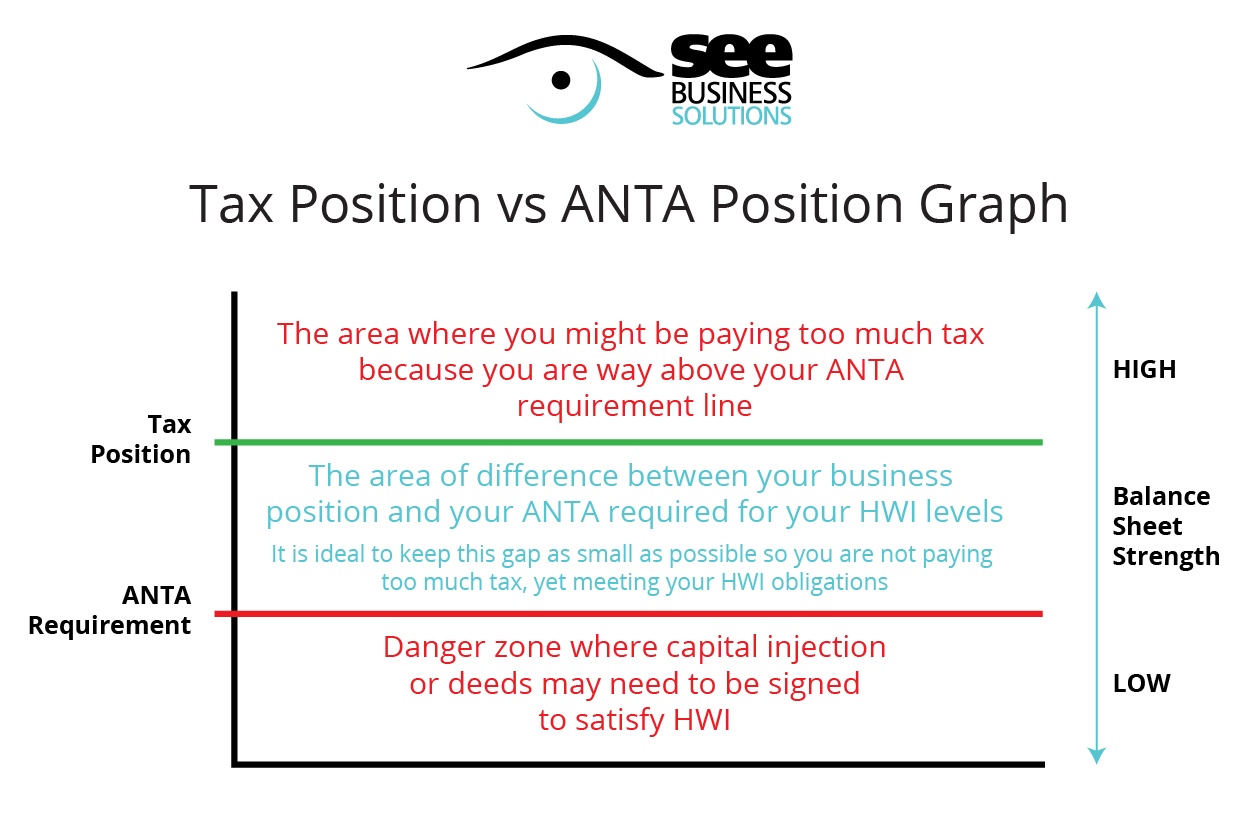

This will alow you to know your floor for tax deductions. What is meant by this is, you would know where your balance sheet needs to sit and it would allow you to work with your accountant (or reach out to our accountant) to minimise your tax, yet stay above the minimum ANTA position required to satisfy your Home Warranty Insurance levels, dependant on your future business goals.

Finally, more importantly, this calculation would assist you in avoiding falling below your required ANTA position and having to inject capital back into your business, or sign a deed against your house.

In summary, complete an ANTA calculation so you know your current position. Cross examine this with your required Home Warranty Insurance limits so you know exactly where your financials need to be (averaged across the two financial years).

If you are way under – you need to improve your financial position.

If you are on par – well done, however there may not be much room for tax minimisation.

If you are way over – there is an opportunity for you to close the gap between the two (tax position and ANTA requirement) and save some money through tax minimisation, or increase your Home Warranty Insurance position more easily if this is one of your future goals.

Feel free to reach out to SEE Business Solutions so you are getting the best result for your home warranty, business structure and financial outcomes.